46+ Irs Installment Agreement While In Chapter 7

Web If this is debt that was incurred prior to filing the Chapter 13 case then the Trustee is not likely to agree to a separate payment plan for the debt this is debt that. Tax Installment Agreement You Cant Afford Its a common problem.

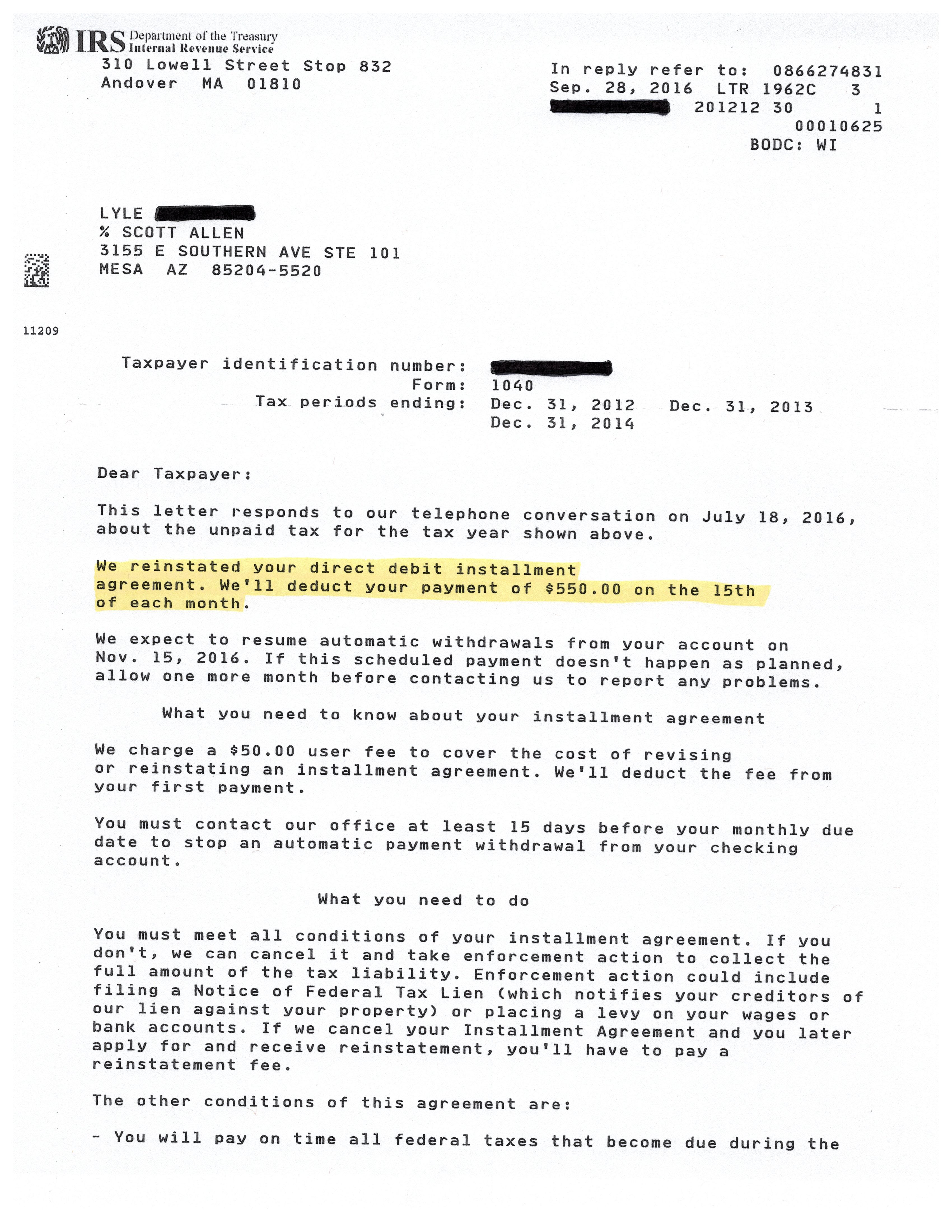

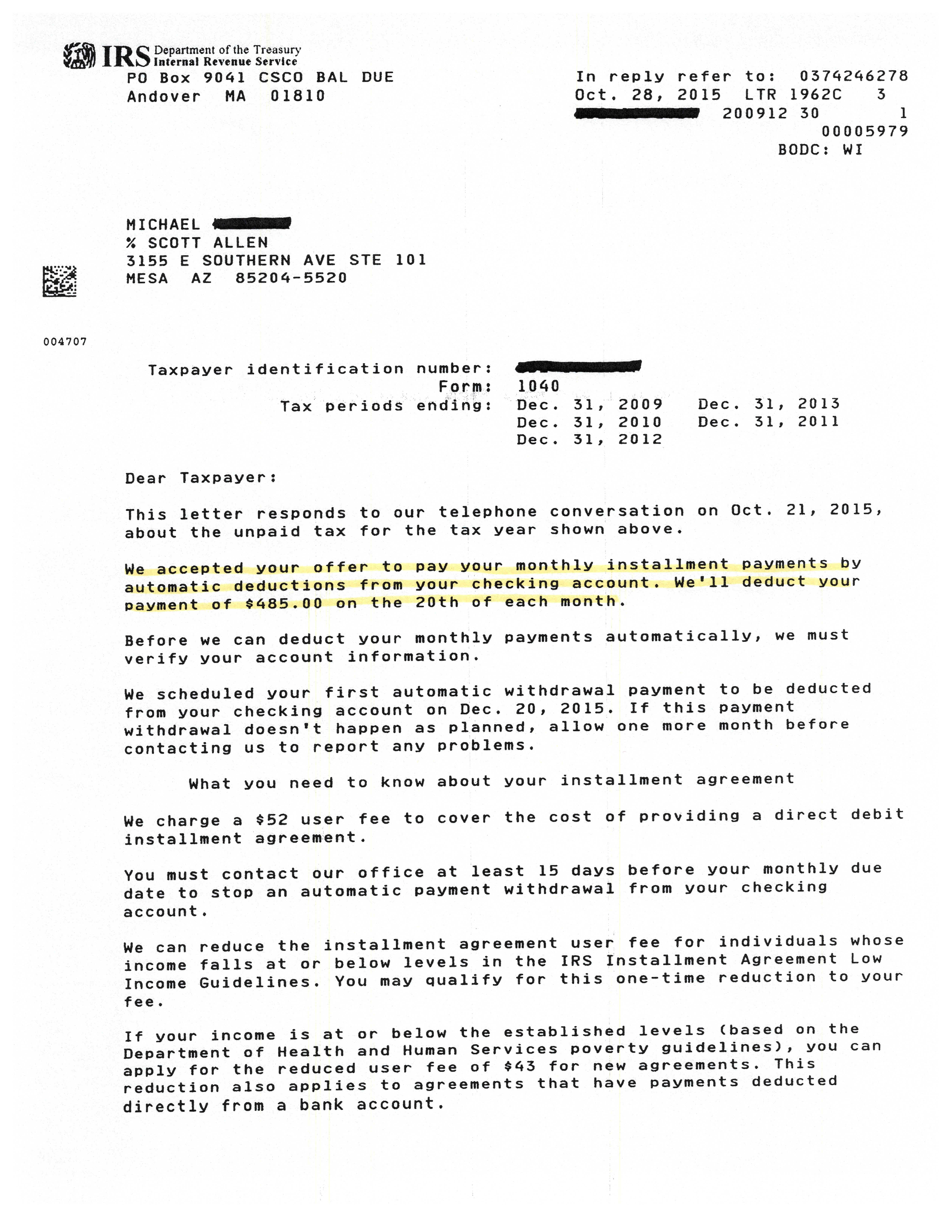

Chandler Az Defaulted Irs Payment Plan Tax Debt Advisors

Web The IRS and the bankruptcy court will not allow you to honor and continue living with that installment plan after you file Chapter 13.

. Instead you must pay all of. You owed income taxes a year or two ago when you sent in your tax. PPIAs usually last until the end of the 10-year collection statute.

You cannot usually include payroll taxes business sales taxes excise taxes or other. Web Taxpayers who need to request a hearing must complete Form 12153 Request for a Collection Due Process or Equivalent Hearing. Web When balances are greater than 50000 establishing an installment agreement can be difficult.

Web 7 attorney answers Posted on Jan 8 2014 Selected as best answer Because of the automatic stay the IRS cannot require you to keep making the payments while the. The amount of tax you owe not counting. Web You must pay that tax debt even though you file for bankruptcy under Chapter 7 or Chapter 13.

Also known as a long-term payment plan these plans are designed to make repaying outstanding tax debt easier for consumers to. Web potential reduction of IRS tax debt because the IRS will be forced by the Bankruptcy Code to separate its claim into a secured component and then a priority component which. Web In a chapter 13 bankruptcy the law allows a few things that can make the situation easier and more realistic than a payment plan based on the IRS budget.

Web What exactly is an IRS installment agreement. A benefit of filing Chapter 13 bankruptcy instead of Chapter 7. Web Were experienced in convincing the IRS to settle for an Installment Agreement that benefits the taxpayer as well based on your income expenses assets and debts.

Web Individuals can complete Form 9465 Installment Agreement Request If required in the instructions please attach a completed Form 433-F Collection Information Statement. Web Only Income Tax You can only discharge income tax through a Chapter 7 bankruptcy. Taxpayers have 30 days from the date of.

Web A partial payment installment agreement PPIA is a long-term payment option. Web Guaranteed Installment Agreements You have the right to an agreement without submitting a financial statement if. Web Chapter 7 can often help.

As noted the IRS tries to collect as much as it can over the.

How Bankruptcy Affects Tax Liens And Repayment Schedules Taxcontroversy Com

List Of Historical Acts Of Tax Resistance Wikipedia

What Happens To Tax Liability After You File Bankruptcy Damiens Law Firm 2022

Free 50 Form Samples In Google Docs Pages Pdf Ms Word

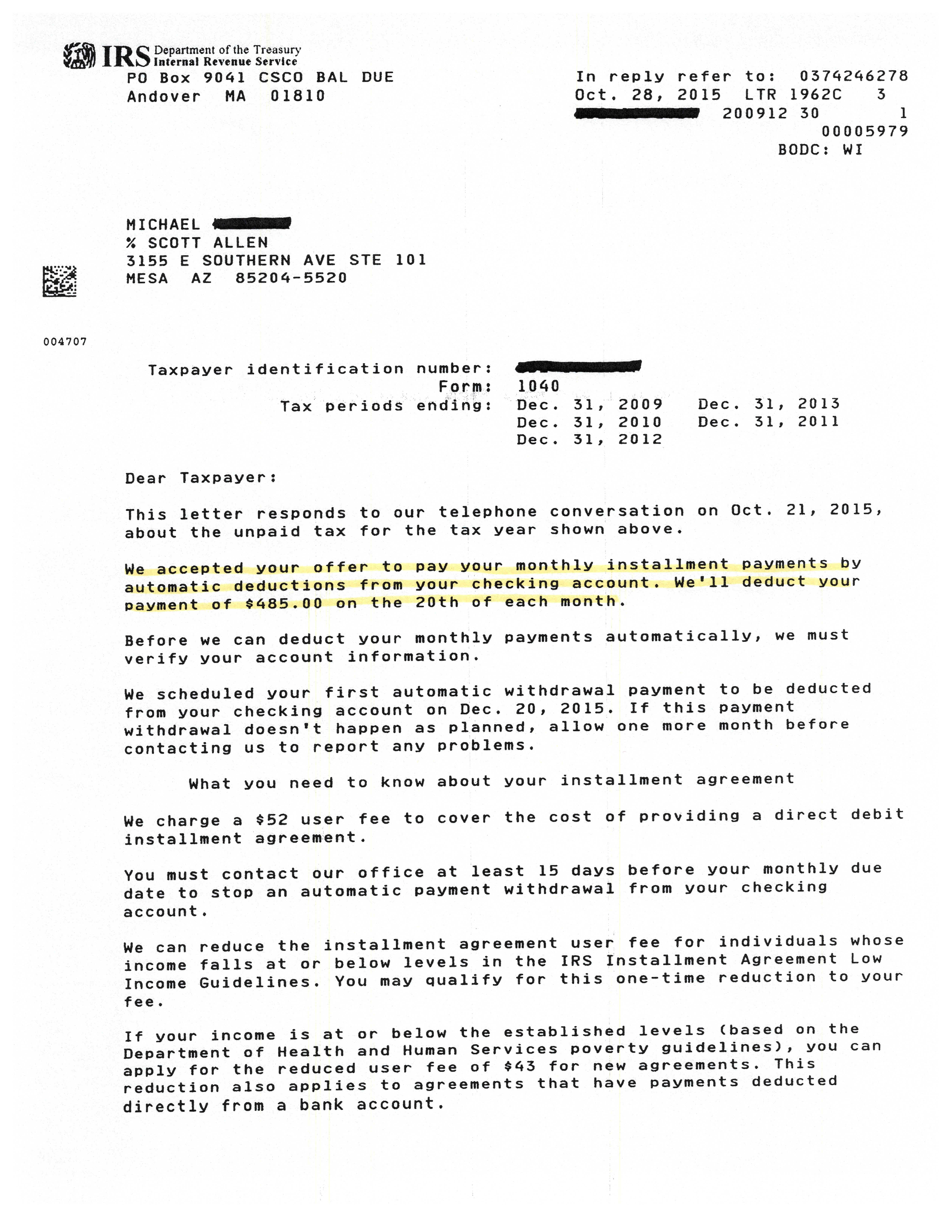

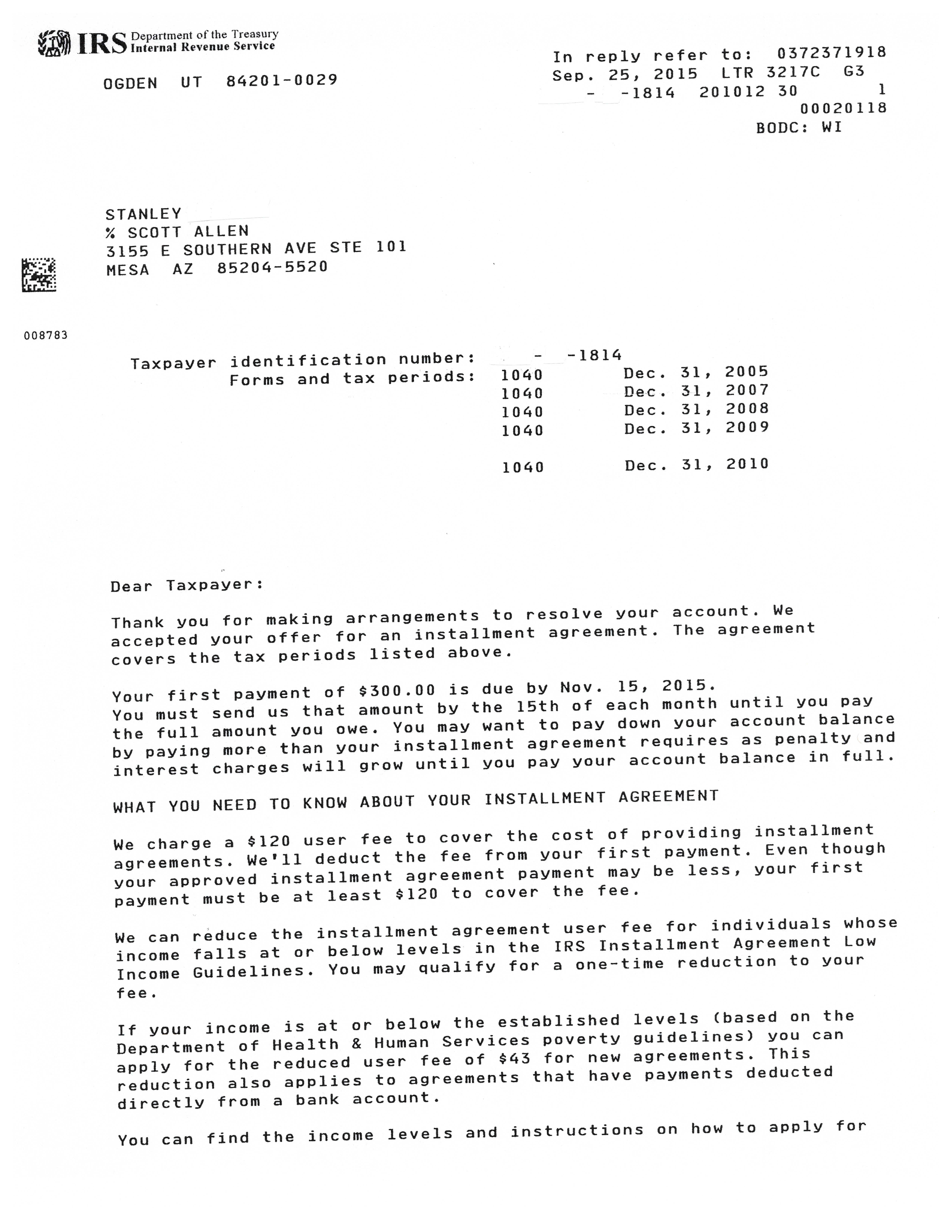

Installment Agreement Tabb Financial Services

Applying For A Tax Payment Plan Don T Mess With Taxes

How A 390 459 Irs Debt Reached A 94 Settlement Landmark Tax Group

Omf 20191231

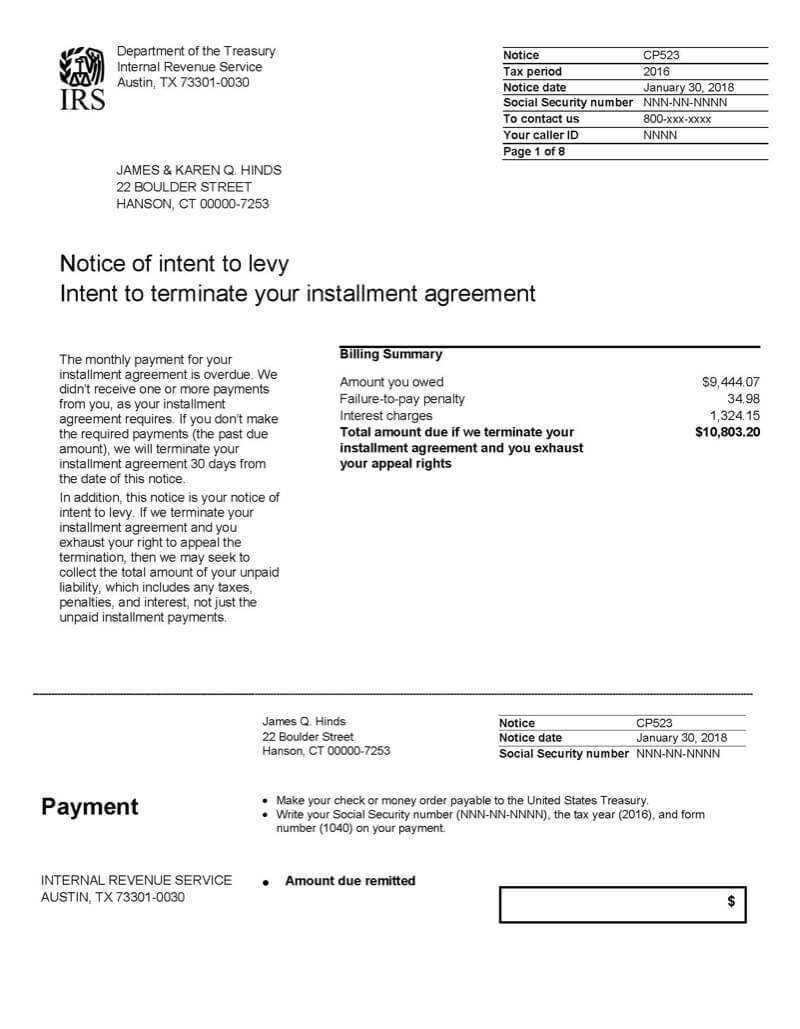

What Is A Cp523 Irs Notice Jackson Hewitt

Success Stories Tabb Financial Services

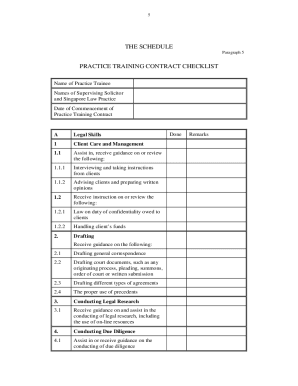

46 Free Editable Agreement Checklist Templates In Ms Word Doc Pdffiller

Top 10 Situations When Bankruptcy Can Resolve A Tax Problem Faith Firm

Installment Agreement Tabb Financial Services

Who Should Do Your Mesa Az Irs Payment Plan Tax Debt Advisors

Understanding The Effect Of Chapter 7 Bankruptcy On Tax Liens Nick Nemeth Blog

Mesa Az Irs Payment Plan Accomplished Tax Debt Advisors

Installment Agreement Tabb Financial Services

Komentar

Posting Komentar